Panel a illustrates the 5Y CDS average recovery rates for the bucket... | Download Scientific Diagram

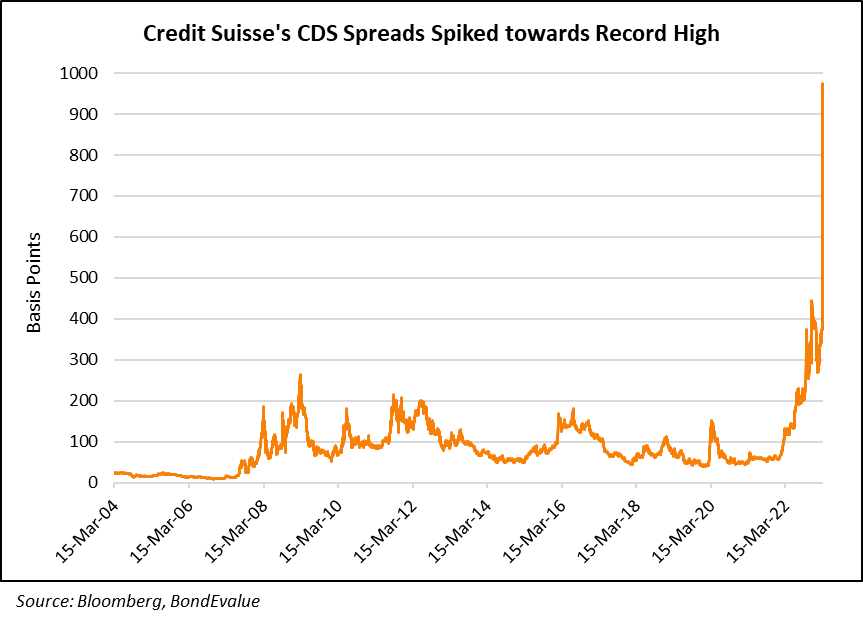

Hakan Kara on X: "Turkey's CDS has touched 800. Assuming 0% recovery rate, this implies a 33% probability of default. At 40% recovery rate (historical averages), the probability of default rises to

Time series plot of CDS spreads and recovery rates The top panel of the... | Download Scientific Diagram

The Pricing of Credit Default Swaps During Distress in: IMF Working Papers Volume 2006 Issue 254 (2006)

The Pricing of Credit Default Swaps During Distress in: IMF Working Papers Volume 2006 Issue 254 (2006)

Panel a illustrates the 5Y CDS average recovery rates for the bucket... | Download Scientific Diagram

![PDF] The Stochastic Recovery Rate in CDS : Empirical Test and Model | Semantic Scholar PDF] The Stochastic Recovery Rate in CDS : Empirical Test and Model | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/ca487f5039471c9a30a5594a555a9fb75d281614/40-Table1-1.png)